Bitcoin, or How to Hammer in Nails with a Microscope.

"The enlightened, disciplined mind is the holiest of holies, a wonder among wonders. Upon the Earth - a grain of sand in the Universe, man is on the order of one-billionth of the smallest magnitude... And yet this particle in your mind's eye, that lives but for sixty or so trips of the Earth around the Sun, possesses a mind capable of embracing the whole Universe... To comprehend this, we must switch to the language of higher mathematics... And so, what would you say if someone were to take from your laboratory a precious microscope and start pounding in nails with it?.. Garin has been treating his genius in just such a manner..."

"The enlightened, disciplined mind is the holiest of holies, a wonder among wonders. Upon the Earth - a grain of sand in the Universe, man is on the order of one-billionth of the smallest magnitude... And yet this particle in your mind's eye, that lives but for sixty or so trips of the Earth around the Sun, possesses a mind capable of embracing the whole Universe... To comprehend this, we must switch to the language of higher mathematics... And so, what would you say if someone were to take from your laboratory a precious microscope and start pounding in nails with it?.. Garin has been treating his genius in just such a manner..."

— Aleksey Nikolayevich Tolstoy, "The Hyperboloid of Engineer Garin." (Translation and emphasis mine.)

"...like a refugee from very rural Pakistan who gets relocated to Oslo, Norway, and still thinks that he could make better food if he were only allowed to light a fire in his living room instead of using that complex electric stove. (This is a real news item. Every now and then, landlords discover indoor fireplaces and occasionally the "newbies" to civilization burn down the building.)"

— Erik Naggum, comp.lang.lisp, 15 October 2002.

By now, nearly everyone has heard of Bitcoin. I will not bother with a detailed account of its mathematical, historical, or political foundations. All of this has been written about at considerable length elsewhere. But a short introduction is in order - if only because the word "bitcoin" has already started to give off a faint smell of spam and cocaine, and it is possible that respectable people who have never heard of Bitcoin will soon be met with less often than respectable people who have heard of it, but pride themselves on staying ignorant of its workings. And being a long-time connoisseur of beautiful technologies which were trampled into the mud by stampeding herds of idiots, I could not resist the urge to say a few words on this subject.

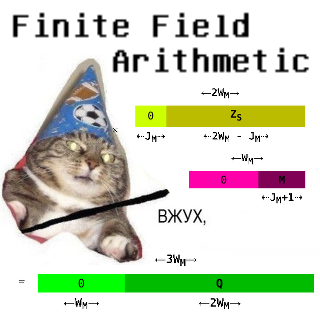

The idea of a cryptocurrency has been around for a while. All you need to create a cryptocurrency is for someone to declare that integers with certain properties are valuable, and put together a system which keeps track of who, at any given time, "owns" every known such integer; plus a means for the orderly transfer of said integers between owners. Bitcoin, like some past attempts at decentralized electronic "cash," satisfied these conditions through Byzantine fault tolerance - in essence, a networked consensus algorithm where all activity is public (albeit pseudonymous and authenticated through public-key cryptography.)

Now, the above would, in principle, be enough for a working electronic cash system. There is still one obstacle: if someone were to proclaim that he is sitting on top of a stash of "valuable integers" and suggest that others should offer him goods or traditional money in exchange for some, everyone would laugh. Firstly, because the natural question is, "why should we pay you for valuable Joe Smith Primes, when we could pay him for precious John Doe Primes? Or better yet, keep our dollars and buy some ice cream?" And secondly, because everyone, even those foolish enough to purchase Joe Smith Primes for a penny each would naturally ask, "why should we purchase these particular Joe Smith Primes, if there is infinitely more where they came from?" [1] Bitcoin satisfies these objections through the use of a Proof-of-Work System, where valuable integers can be searched for only by carrying out a computationally-expensive task, in conjunction with hash chaining, where the exact nature of the task at any given time depends on every past solution found, and on a faithful record of past transactions (cleverly dovetailing with the Byzantine consensus apparatus mentioned previously.) The latter process is referred to as "mining." Thus, no one person starts with a vast supply of Bitcoins. And the properties of the "valuable integers" in question are well-understood, and from them it follows that there can never exist more than 21 million Bitcoins in total (each one, fortunately, can be subdivided, much like certain gold coins once were.) And that "mining" will become exponentially more difficult as this limit is approached. Mathematically-inclined readers should refer to the original paper on the subject. From this point on, we will ignore the mathematical details, save for assuming that the algorithm works "as described on the box" - something a great number of first-rate mathematical minds have verified to their satisfaction. Which does not, of course, rule out the possibility of a yet-undiscovered cryptographic flaw - whether of the accidental or the intentional kind.

Bitcoin is quite different from all traditional currencies, as it is decentralized and non-inflationary, as summarized above. The closest resemblance is perhaps to monetary gold - a rare metal, one easily tested for purity, and the supply of which increases very slowly. Of course, gold cannot be teleported, or concealed on a thumb drive, while Bitcoin can. Thus the latter has become a popular subject among self-styled revolutionaries and protesters of all stripes, as well as the frugal, the fraudulent, and the merely avaricious.

Of course, any scheme that promises to become a more convenient means for the reliable storage of wealth than keeping bricks of precious metals around is also of some interest to ordinary people, especially in its early stages, when there may be some intrinsic reward for getting in "on the ground floor":

"One metaphor for monetization is that of a storage vessel, like a battery for electricity or a tank for compressed gas. When people buy into the currency, they are charging the battery and compressing the tank. When they sell out, they are discharging the battery. When new currency is created (perhaps by alchemists) without a buy-in, the tank has sprung a leak... If Bitcoin becomes the new global monetary system, one bitcoin purchased today (for 90 cents, last time I checked) will make you a very wealthy individual. You are essentially buying Manhattan for a quarter. There are only 21 million bitcoins (including those not yet minted). (In my design, this was a far more elegant 2^64, with quantities in exponential notation. Just sayin'.) Mapped to $100 trillion of global money, to pull a random number out of the air, you become a millionaire. Wow!"

"Here is the problem with Bitcoin: the tank, I think, will pop. This is not due to any technical fault in Bitcoin's algorithms or economics. It is due to a political fault in our society, which is that we're governed by dumb people. Because we're governed by dumb people, here is what I think will happen with Bitcoin. Stage 1: Bitcoin does not exist. Stage 2: Bitcoin exists, but is worthless. Stage 3: Bitcoin exists, and is used by strange and desperate weirdos and geeks. Stage 4: Bitcoin is used by Slashdot readers, perhaps slightly less desperate. (You are here.) Stage 5: Bitcoin is used by criminals. Stage 6: All Bitcoin exchanges are shut down by USG. Stage 7: Bitcoin exists, but is worthless. Stage 8: Bitcoin does not exist."

"At least on the surface, Bitcoin exchanges violate the critical know-your-customer rule which USG enforces on all money-transfer businesses. As a money-transfer business, you are essentially an agent of the government - a spy. To a regulator, Bitcoin seems like a way to transfer arbitrary quantities of money anonymously. This is a nonstarter, and the regulator knows exactly whose necks he has to squeeze - the spies who are not doing their jobs. He cannot shut down Bitcoin itself. He can trivially shut down Bitcoin-dollar exchanges, or even Bitcoin-gold exchanges. Probably seizing all their dollars, etc. He probably can't seize their bitcoins, but it doesn't really matter. To save in a currency is to place your trust in that currency. If you put energy into this great collective battery, you have to be able to get it back out. If that trust can be convincingly damaged, the currency has no chance. If people lose money in bitcoins, the currency can never recover. No one will ever again exchange it for dollars, or even alpaca socks. It will be dead. Its chances, now and forever, will be zero - not even epsilon. If Bitcoin was centralized - sacrificing all real coolness - it could deal with this problem, perhaps, by applying KYC to all dollar transactions. But Bitcoin is not centralized, so there is no way the development team can prevent exchanges from operating. These exchanges are obvious targets for numerous predatory authorities. When they are destroyed, the currency dies."

— Mencius Moldbug, "On monetary restandardization."

All modern governments stay in power by skimming from every "storage tank" (taxation), as well as by monitoring and keeping tight control of trade (in strategic commodities, arms, and just about everything else.) So the above is more-or-less a no-brainer.

As economies around the world continue to tank, governments everywhere are certain to grow more unabashedly tyrannical and desperate to stay in control of trade and the storage of wealth. Dmitri Orlov describes the fate of one foolish (physical) coin peddler who dared to market his wares as an "alternative" currency in competition with the U.S. Dollar:

"...precious metals have been and continue to be a spectacular investment, and a good way to avoid being robbed blind by the out-of-control printing presses at the US Treasury. But eventually it goes off into ontological self-delusion—that gold and silver are “real” money, as opposed to paper fiat currency, which is “fake” money. Ladies and gentlemen, it doesn't matter whether or not it's shiny; it's all as real or as fake as you are. Some people go straight over the edge and decide to take the law into their own hands and, waving about a dog-eared copy of the US Constitution, set off to coin their own “coin of the realm,” not realizing that the realm isn't theirs. If the realm is financially stable, it will simply change the rules to make such a gambit unprofitable. If the realm is financially distressed and teetering on the verge of collapse, it will panic, shout “Terrorism!” at the slightest provocation, and the result is long-term political imprisonment for the ontologically deluded:March 21, 2011

WASHINGTON (Reuters) – A North Carolina man was convicted for creating and distributing a counterfeit currency that was very similar to the real dollar, a U.S. Attorney said.

Bernard von NotHaus, 67, minted Liberty Dollar coins in the value of $7 million dollars. The conviction concludes an investigation that was started in 2005.

“Attempts to undermine the legitimate currency of this country are simply a unique form of domestic terrorism,” Anne Tompkins, U.S. Attorney for the Western District of North Carolina, said in a statement on Friday.

“While these forms of anti-government activities do not involve violence, they are every bit as insidious and represent a clear and present danger to the economic stability of this country,” she said.

This Reuters story has since been taken down, after being ignored by media in the US (but not in Russia). Von NotHaus is looking at 20 years in jail. This is a lot, you might think, for stamping some politically edgy shiny trinkets, but then Stalin gave out similarly long sentences to millions of people for doing absolutely nothing, so let us count our blessings. Let's get one thing straight, though: in the United States, by law, anyone who, “except as authorized by law, makes or utters or passes, or attempts to utter or pass, any coins of gold or silver or other metal, or alloys of metals, intended for use as current money, whether in the resemblance of coins of the United States or of foreign countries, or of original design . . .” faces a fine or imprisonment. It is the same in every other country: the term “coin of the realm” implies that it is the realm that controls creation of all coinage and its circulation. You can wave your US Constitution around, or you can swat flies with it, or you can use it as kindling: the result will be exactly the same. "

— Dmitri Orlov, "Financial Totalitarianism."

Nearly every serious student of the subject seems to believe that Bitcoin will be ruthlessly suppressed in the near future. The only disputed details appear to be: what form the ban will take, and how it will be enforced.

Now, as Mr. Moldbug pointed out, if our rulers were truly clever, they might allow Bitcoin to live on indefinitely as a kind of honeypot. And if we are ruled by dull and desperate thugs, as Mr. Orlov believes, Bitcoin will be banned and woe be unto anyone who is found exchanging money or goods for a cleverly-chosen integer, or vice-versa. There is certainly plenty of precedent for tyrannical bans on exchanging illegal bits - and certainly for arbitrary restrictions on the voluntary exchange of currency and goods. It is entirely conceivable that incorrigible Bitcoiners will soon find themselves in front of firing squads, or at the very least, thrown into pits where they are to be tortured to death or driven mad by violent criminals. No one save a few digital activist weirdos will notice or care.

But what if our rulers are clever, but not foolish enough to risk allowing anonymous, decentralized electronic cash to live on and grow in economic importance? There is some evidence for just this scenario. Said evidence also sheds light on the question of why the Bitcoin system was allowed to be popularized and grow to its current scale. A clever tyrant would not remain content with merely filtering packets, or even shooting a few Bitcoin users in the public square to make an example. Instead, he would discredit the system in the eyes of its users - steering rebels, contrabandists, and digital misfits of every other kind back to old-fashioned, state-controlled money.

The real laugh is that there is no solid reason to believe that the world's national banks have seen it fit to sweat so much as one drop to vanquish Bitcoin through discreditation. Bitcoin users themselves have been doing a thorough job of this. Consider the case of GLBSE, (an abruptly-defunct) Bitcoin-based stock exchange:

"GLBSE user funds are more or less safe, but I have bad news from the GLBSE shareholder meeting.Nefario has, without a shareholder motion and in violation of the bylaws and GLBSE ToS, decided to close down GLBSE. Users will be able to collect deposits only after submitting identity info. A similar system to the one that Goat was forced to use will be provided so that assets can be traded elsewhere.

He is also illegally using user deposits to pay for his lawyer. If he continues, the GLBSE cash reserves (which I manage) will not be enough to cover costs and GLBSE will be in debt to users.

I'm very sorry about this, but those shareholders who are sane are helpless against Nefario and the insane shareholders who for some mind-boggling reason think that closing down GLBSE in this way will help both themselves and GLBSE users.

Since Nefario refuses to give complete details about his legal concerns and he has been acting strangely, I feel that it is somewhat possible that Nefario is working under some sort of plea bargain and is gathering IDs for future prosecution.

Nefario has defrauded me and others in several different ways and deserves a scammer tag.

- The BitcoinGlobal bylaws state that BitcoinGlobal's purpose is to operate GLBSE. By shutting down GLBSE without amending the bylaws, Nefario has violated the bylaws.

- He has stated that he would ignore any motion to remove him as CEO.

- He is knowingly making BitcoinGlobal shares worthless, violating his fiduciary duty.

- He is refusing to release my GLBSE balance without my ID, which I did not agree to.Since my GLBSE shares are now worthless, it should be obvious that I had no knowledge of this before now.

I urge everyone to never work with Nefario again. A Bitcoin stock exchange is a good idea, though. I hope that someone will create something better than GLBSE and MPEx."

The answer instead is that, while the unknown inventor of Bitcoin was quite clever, most of its users are alarmingly dull. This includes the "pioneers" who set up Bitcoin-based financial services of every kind. Why? Because they are pounding in nails with a microscope. These fools have been handed a technology so clever, so disruptive and revolutionary, that the rulers of the world would have to fully unmask themselves as ruthless tyrants in order to suppress it, --- or give up their thrones on their own free will --- if it were used correctly, that is. But at present, the microscope again and again goes "clang!" against the table, the nails slowly and crookedly creep inward, and tiny shards of the world's finest lenses fly in all directions.

Bitcoiners are pounding in nails with a microscope, because they have insisted on faithfully re-creating the financial institutions of the meatspace world - banks, stock markets, derivatives trading, and the like - without any of the familiar meatspace law enforcement mechanisms (police and courts) or the best-known traditional black-market alternative to these mechanisms: the threat of immediate physical violence as an incentive to promise-keeping.

Satoshi Nakamoto, the supposed inventor of Bitcoin, could be a Bourbaki or a man in a grey suit drawing an NSA salary. But whoever he was, he handed this lot of morons a true jewel of "alien technology." With which they proceeded to knock one another on the head with, exactly as they did with their stone-age cudgels the day before. Bitcoin allows the user to exchange value without physical proximity, without the use of a central arbitrating authority, anonymously, and without having to trust anyone (save for the "Byzantine-condition" assurance that a plurality of users are running the actual Bitcoin algorithm, and not a subverted version.) And yet the fools insist on building shoddy copies of meatspace institutions where the cryptographic perfection of this jewel is all for naught, and we're back to having to blindly trust the user on the other side of the Internet connection when he insists that he will invest our virtual coins in real-world commodities (or the paper imitations thereof), and return some of the proceeds to us in the future. And with none of the admittedly-limited safeguards of meatspace in the mix. Yes, the meatspace universe contains Bernie Madoff, Jon Corzine and their many merry friends. But in the present-day world of Bitcoin, any digital bum who can set up a Linux box and string together some slick words imagines himself a Corzine. And, what is far sadder, fools invariably show up, ready to part with their Bitcoins on their own free will. They give them up in exchange for promises, backed by nothing at all. And then have the gall to complain.

For those who like the idea of Bitcoin but are disturbed by the fraud artists who ply their trade with impunity, there are several choices to consider:

1) Stick with means of value storage and exchange backed by traditional, more-or-less reasonable and predictable legal systems, where the keeping of one's word is encouraged using the threat of draconian punishment. However, legal systems which meet the "reasonable" and "predictable" conditions specified here are growing rather thin on the ground. So quite a few people are sure to remain interested in the alternatives below:

2) Build electronic systems based on Bitcoin (or other decentralized electronic cash) which incorporate "web of trust" mathematics. Perhaps this could even be done in some especially-elegant manner, where a Bitcoin in the possession of a widely-trusted individual is actually worth more "units of value" than one owned by a newly-created or disgraced account holder. Study the theory of Secure Multi-Party Computation. Perhaps a low-tech inspiration for this kind of thing could be Hawala, a word-of-mouth banking system successfully used in the Islamic world since the 8th century - and which no modern country has been able to suppress, despite plentiful reasons to try.

3) Build electronic systems based on Bitcoin (or other decentralized electronic cash) which scarcely require you to trust anyone at all - just the same as Bitcoin itself. The weak link here is the connection between the world of of electronic currency and real-world physical goods (and traditional money.) Possible solutions here include mechanical delivery systems, perhaps controlled by multiple parties: dead drops, "geocaches" or even autonomous flying machines:

...Or: Bitcoin users could ignore the above, as I'm quite certain they will, and happily carry on signing up for "banks" and "stock exchanges" run by take-the-money-and-run artists. And steadily cement the reputation of the system as a sad joke. And on the positive side, a few die-hard activists might thus avoid facing the firing squad. Using Bitcoin will become its own punishment, the way sniffing glue is. But the down-side is that we won't learn just what sort of world is possible given a functioning, decentralized cryptocurrency (perhaps an interesting, albeit somewhat macabre one. Or possibly a somewhat boring one: something like a more consumer-friendly version of the world organized criminals presently live in - the world of Swiss numbered bank accounts and airborne luggage trunks full of diamonds.)

Edit: And here is another idea for a more trustworthy yet equally-decentralized Bitcoin.

[1] Primality is mentioned here solely for the sake of argument, since we are discussing classes of "special integers," and primes (and certain varieties thereof) are one kind of "special" integer known even to schoolchildren.

How many years has ThePirateBay been up? They're not going to shut down the bitcoin network, unless they pull the plug on the whole internet. I wouldn't put that past them.

I didn't take bitcoin seriously, until I realized that drug dealers were taking it as payment. If a drug dealer thinks BTC is money, well, so do I.

I think that exchangers are the weak link in the whole bitcoin world, but it's not the end of the world if they are all eventually shut down or watched and monitored.

People trade fiat -> BTC and BTC -> fiat on BitMit and Silk Road. It may become tricky to move money around in size using BTC, but for small transactions, I don't see anything smart the gubmint could do to stop people from using it.

I suspect that propaganda will be their main tool, and not law enforcement.

Also keep in mind that all of the events that have happened with BTC have not had anything to do with the BTC network itself, but rather website security. I would characterize the BTC exchange world as being a bunch of 12 year old boys who have built their very first exchange website. The fact that someone thinks highly enough of the value of bitcoin that they would bother to steal them - actions speak louder than words do.

It's early days, most of these website security issues will sort themselves out. The exchangers remain vulnerable, but when they go, people will find another way. They always do.

I worry about an internet kill switch or a blockchain fork. If the NSA decided to start mining, they might be able to fork the blockchain, god knows how much computer power they have hidden away in their sooper sekrit bunkers.

Dear exiledbear,

Six months ago:

Today, one of our researchers discovered that according to Blockchain.INFO, a miner at 85.214.124.168 currently has approximately 15% of the total hashing power. This, in itself, is every day news. However, the strange or even frightening fact is that it is producing empty blocks (single transaction blocks).

("Bitcoin War: The First Real Threat to Bitcoin?")

And some time last year, the NSA held a closed-doors (though publicly-announced) seminar on Bitcoin.

And do we really know who controls most of the remaining mining capacity? U.S. government agencies have invested $billions in computer security research, and have unabashedly admitted to spreading elaborate malware. (E.g. Stuxnet and friends.)

And the "Bitcoin is a honeypot" hypothesis is surprisingly well-founded.

Intelligence agencies and other "soft power" organizations are interested in Bitcoin for the same reason as they are interested in "social media" - real anonymity takes serious work, and most users are not interested in doing said work. Systems with a reputation for anonymity will thus draw in plenty of people who believe that it will somehow come about by magic, and end up sharing plenty of secrets quasi-voluntarily.

Yours,

-Stanislav

Yeah, the fright over 85.214.124.168 was a tempest in a teapot and you ought to know it. It's happened a few times since then, too.

Fact of the matter is that Blockchain.info uses an algorithm to determine whether the IP address they learn about a transaction from is the direct sender, or a relay node, and they try to filter out the relay nodes so that they are only publishing direct-sender addresses. But they get it wrong pretty frequently.

Also, if you think GLBSE is bad, here are some more acronyms - CME, MFG, PFG.

We're all on our own these days. The law don't mean shit if you got the right friends, that's how this country's run. Twinkies are the best friends I even haaaaaaaaad....

I think you have quite a marvelous writing style, and also think this is article in particular is an excellent article well worth reading. I would love to provide you with valuable integers in support of your future writing endeavors on the expectation that similar levels of wry wit and insight will be achieved, but your website is sadly lacking a Bitcoin address to send these valuable integers to.

Dear Omnifarious,

If you look closely, this page has an ordinary donation button. Which takes donations in boring old national currencies. As you can probably guess, I am not, at present, much of a Bitcoin user. (Although my collection of FPGAs, kept around for an entirely different purpose, sometimes mines Bitcoin.)

Yours,

-Stanislav

Of course, if you decide you do want to accept these prime numbers, here is an article that will get you started in moments: http://gary-rowe.com/agilestack/2012/01/09/how-to-accept-bitcoins-on-your-blog-with-no-code/

The tool set is still being built. Non-repudiable payments are but one part. If you aren't familiar with baling in your bitcoins to an Open Transactions server (just one of many innovations that are here one being built) then don't discount Bitcoin's future by looking at its past.

What the author states is the obvious. All of this has been discussed in the forums. I find the author arrogant and thinks he is superior to everyone.

Dear Jim,

The basic mechanics of Bitcoin are, of course, described in exquisite detail elsewhere, including the forums. That part was meant as a crash course for my usual readers, many of whom have never heard of Bitcoin. As for the pitfalls, if only it were true that they were obvious to all! They were clearly something other than obvious to the people who fell for GLBSE and other scams. And I admit that it is hard to avoid sounding like an arrogant arse when discussing chumps who gave up an ocean of money in exchange for empty promises, while knowing that they would have no recourse.

I for one have shitty bedside manners when hearing the complaints of people who stuck their hands into unmistakeable bear-traps and then cried: "it hurts!"

Yours,

-Stanislav

I wouldn't worry about people thinking you're an arrogant arse (and I doubt you do, really) - that's part of why your usual readers come back for more.

Good article, by the way.

[...] by alexkravets link 1 [...]

GLBSE is not a scam; governments are scams.

Dear majamalu,

> GLBSE is not a scam

What have you been smoking?

Yours,

-Stanislav

Depressingly good article. 🙂

I hope you are wrong, but I don't think so.

This is an interesting and well thought out article, although many of the topics you have expressed an opinion on have been discussed at length in the Bitcoin forums, and Stack Exchange site (see http://bitcoin.stackexchange.com)

You're right that in general governments seek to control the money and trade. This secures their power base and allows them to perform their primary function as a protector of their people (enforcing of legal contracts, extraction of taxes to pay for infrastructure and defence etc). Opinions vary on how much intrusion into their citizen's lives should be tolerated, but that is a different topic entirely.

It would be interesting to explore how an end-to-end Bitcoin supply chain would be subjected to the kind of pressure you describe. For example, it is very difficult to regulate the System D economy which is essentially adhoc and cash-based. This would seem to be the closest parallel to the growing Bitcoin economy and I would be interested to hear your thoughts on this.

Dear Gary Rowe,

An end-to-end Bitcoin supply chain, where an employer pays you in bitcoins, with which you proceed to pay for housing, food, etc. would be the end of government as we know it, because national banks would lose their ability to steal wealth from the population by printing money. Nor would it be possible for a government to impose sales taxes, or to track the movement of money into and out of the country.

This is why no such thing will ever be allowed to happen, if our rulers have anything to say about it.

Yours,

-Stanislav

If a development detrimental to the government would mean its speedy end, we would not be typing messages and discussing this topic on the Internet. The Internet has started the downfall of the old establishment, slowly but steady. The old propaganda is wearing thin, alternative media is a much better source for info than the offiical channels. It's already happening and BTC will add to that effect.

It's the Fourth Turning.

Institutions will battle, but it will be in vain. Stupid people losing money on schemes are still by far found in the US Dollar world. That the same happens in the BTC world doesn't mean a thing, other than that BTC users are of the same species: humans. Personally, I think BTC is not limited, but our fellow-man is, especially in herds The knowledge on spread of new technology is there: it takes only 13-15% early adopters to get this going. Even if someone doesn't care, it's a far better bet than the State Lottery.

So I do not agree to your thesis that BTC will be a 100% fail, but I enjoyed reading your article nevertheless. I hope you will reflect and elaborate on this single part in the future:

"a technology so clever, so disruptive and revolutionary".

You write well, so let us have it.

I think I'd like to highlight his one-two punch. He doesn't say Bitcoin will fail only because of the noise from stupid users, he thinks that those in power will take advantage of that noise to sway public opinion in their favor as they pass international laws/treaties to globally outlaw bitcoin exchanges.

If they can do this before we reach your 13-15% adoption anywhere which can really build it's own end-to-end supply chain, then it would be a blow difficult for Bitcoin to maintain it's relevance against. If miners can't mine to keep the network secure, then Bitcoin could be scattered as easily as many of it's alt-chain followers have been.

My take is, I do not bet that those in power *are* as clever or as coherent as Author gives them credit for. I think they are of a dissonant hive mind. Many individuals in power will discount bitcoin, many will root for it, not enough will work to start cleansing the infection before we metastasize.

What Author forgets to factor into his calculation is that: While Bitcoin early adopters are, in fact, all monkeys..

so are those in power. The playing field is much more even than it seems, and our alien technology (and others like it we are bound to find over time) will help to give us the edge we need to win. Because Politics lack the world-changing horsepower of technology; even though all of the above are operated by monkeys.

Of course it helps that the mad genius Satoshi is likely still among us, just under one or more different assumed identities. ;3

After my first impression of you being an annoying, pretentious SOB, "...being a long-time connoisseur of beautiful technologies...",

I really enjoyed your post. You take it significantly beyond the usual misinformed, tip-of-the-iceberg basics and touch on many relevant, thought provoking and fascinating aspects of bitcoin's ingenuity. I also enjoyed jumping off to several of the links that you took the time to embed.

Since bitcoin can't be completely (globally) shut down, I'm "banking" (haha!) on the simple economics of supply and demand. A principle so foundational that even bitcoin must play by its rules. In 10 years maybe I'll have to move to a bitcoin-friendly country to cash in my investment (Finland, Sweden,Norway, New Zealand, Switzerland...) but that's fine with me. And if not? Well, I've still got my Social Security right?

Dear jnthnrk,

> Since bitcoin can’t be completely (globally) shut down, I’m “banking” (haha!) on the simple economics of supply and demand.

If all national currency-based Bitcoin exchanges were to be suppressed, demand could become rather low indeed. That would be Moldbug's Stage 7:

"... Stage 4: Bitcoin is used by Slashdot readers, perhaps slightly less desperate. (You are here.) Stage 5: Bitcoin is used by criminals. Stage 6: All Bitcoin exchanges are shut down by USG. Stage 7: Bitcoin exists, but is worthless. Stage 8: Bitcoin does not exist.”

And one should note that all of the countries you mentioned happily dance to the U.S. financial policy tune.

Yours,

-Stanislav

2) Build electronic systems based on Bitcoin (or other decentralized electronic cash) which incorporate “web of trust” mathematics. Perhaps this could even be done in some especially-elegant manner, where a Bitcoin in the possession of a widely-trusted individual is actually worth more “units of value” than one owned by a newly-created or disgraced account holder. Study the theory of Secure Multi-Party Computation. Perhaps a low-tech inspiration for this kind of thing could be Hawala, a word-of-mouth banking system successfully used in the Islamic world since the 8th century – and which no modern country has been able to suppress, despite plentiful reasons to try.

This reminds me of the Whuffie, as described in Corey Doctorow's book Down and Out in the Magic Kindgom. Which details a StarTrek-esque world without currency, but preference is given to those with more Whuffie, a reputation system enforced by an ad-hoc network of users.

So, for better or worse, it's a bit like reddit-karma-in-real-life.

I was ready with knives and a roasting thermometer when I first learned of this article, however, some time spent considering your well-crafted essay has obviated the need for such implements.

You are correct in that technology implemented by well-meaning yet unsophisticated users is futile at best, especially when creating services that require strong security measures from the ground up.

Most horror stories center around lapses of users, admins and hopefuls that haven't done their homework. At the same time, it points to the scarcity and increasing value that bitcoin has - if it was considered worthless, there wouldn't be hackers and others out to get it.

I firmly believe that bitcoin will not be shut down as described in your article. I base that belief on the existence of other networks that continue to flourish, such as torrents, despite active measures at the internet level and legal avenues to restrict their activity.

Personally, I think the evolution of this hybrid payment-system-and-currency will go from exchanges transferring BTC (bitcoin) to other currencies to dying off all together as their services will slowly not be needed. As for governments not allowing such free commerce to exist, perhaps it would be a force to enact change - as taxes would become a more voluntary nature where we would only contribute to specific items that we actually need. (Instead of a flat 'fee' that is then distributed without the taxpayers consent.)

Bitcoin is a financial revolution that will change everything. Even if the current system falls under some unknown future threat, its existence has shown that there is another way to create a financial system that isn't dependent upon the failings of human decision processes and politics.

Dear TraderTimm,

I admire your optimism. But I have trouble imagining that the financial elites who have ruled the world for centuries, as well as the governments they have bought and paid for, will decide to pack up and go home without a fight. If Bitcoin ever threatens to expand beyond the "Internet crackpot niche," you can expect key players (Bitcoin exchange operators, and in general, anyone with a serious bitcoin stash and a traceable legal identity tied to it) to start having serious problems - legal and otherwise. The troubles inflicted on torrent sites, P2P file-sharing, warez sites, etc. will pale in comparison, as the stakes here are unfathomably greater.

Yours,

-Stanislav

Dear TraderTimm,

My other point is that, at present, Bitcoin is quite non-threatening to the powers that be, because its users are re-creating traditional institutions (banks, stock exchanges, and the like) with none of the legal safeguards.

Framing the problem as one of computer security is an error - it is a problem of trust. A Bitcoin-based service can work exactly as described, until the owner decides that it would be to his advantage to simply abscond with all of the coins which have been entrusted to him, run them through mixers, and never be heard from again. Again, this is not a computer security issue in the ordinary sense.

Attempts to "legitimize" Bitcoin commerce by tying Bitcoin identities to established corporate ones will sometimes work (people trust the large exchanges to actually work as described because one can, at least in principle, sue them in traditional courts for breach of contract) - but this kind of thing ultimately destroys the original purpose of decentralized, non-state-controlled currency. Instead, the way to go is to build on the mathematical foundations of Bitcoin to create larger systems which are equally decentralized, where, for example, one party in a transaction could deliberately make itself vulnerable to reprisal from customers should the latter be dissatisfied with the results of a transaction (see this.)

But, as I explained, if Bitcoin is "fixed" with satisfactory trust-mechanisms, and made sufficiently palatable to ordinary people such that it catches on in the mainstream, our rulers will act, and do whatever it takes to drive the value of a bitcoin down to zero, as quickly as possible. Do you imagine that they will find it at all difficult? If the penalty for buying or selling a bitcoin in your country were life imprisonment, would you still do so? How many fellow users do you suppose share your convictions?

Yours,

-Stanislav

Let's assume that collapse of US dollar as world reserve currency will happen and US will lose its economic power. In that case it won't be possible for US to enforce it's financial regulations anywhere outside of US, e.g. no another country would comply with things like FATCA, because they won't gain anything from it. The economic chaos will enact political chaos in some regions as well.

What I would like to point is that in case the above scenario comes true then Bitcoin will have window of opportunity to gain adoption during time of chaos when there won't be a force to stop it.

Dear Serith,

My personal guess is that Bitcoin will be banned - or neutralized through more subtle means - long before the US empire fades away to the point of becoming harmless.

And one unfortunate fact is that serious economic chaos (e.g. Argentina) is quite incompatible with steady Internet access (or even a reliable electric grid.) In such situations, ordinary people become preoccupied with physical survival, and commerce rapidly devolves to the level of barter in the immediate necessities of life. I like to call this case "a transition to the lead standard." You've no doubt heard of "gold bugs," who invest in gold in anticipation of a return to the gold standard. Correspondingly, a "lead bug" would invest in... ammunition. If you believe that an Argentinian scenario is imminent, consider becoming a lead bug.

Yours,

-Stanislav

Yeah, that "lead bug" bit you just threw out there was at least as genius as the entire article. Had to comment on how clever that is. Memorable as heck. Kudos.

I agree with the other poster about your writing style. This was a good article in terms of content & presentation. Just more assurance that I made the right choice not going with BitCoin. Like you, I still think it has plenty of potential that people just haven't figured out how to use. Heck, the BitCoin scheme itself is clever in quite a few ways & portions of it might end up in solutions to unrelated problems. Only time will tell.

I agree with the other posters about your writing style.This article answered some of my questions about bitcoin, and created new ones,which is always a good thing for me.

However the language you are using is somewhat harsh,and it always saddens me when smart people do that.

any digital bum who can set up a Linux box and string together some slick words imagines himself a Corzine.

The grammar nazi inside me, informs me, that "string together some slick words" is invalid. Words can not be slick.

I think better usages could include:

"string together some slicked words" does sound much better, or

"a word slickster strings together some words" or

"the wording of a slickster" or

"slicked wording"

Anyway i am not a native speaker of English,let alone that i am a digital bum,so what do i know?If you happen to be sure that your view is correct,please enlighten me.

I believe the author wrote that sentence informally. What is missing are commas, as such:

any digital bum, who can set up a Linux box and string together some slick words, imagines himself a Corzine.

Better?

Commas are sadly missing from most informal writings nowadays. Happens to include all blogs and most news articles that are churning the 24 hour cycle. I tend to insert them automatically as I read, this habit reduces a great deal of aggravation.

[...] thing a crook needs is an impeccable reputation.” (Attributed to Agatha Christie.) Bitcoin interests me as an obvious example of a technological jewel tossed around aimlessly by the b... I can’t help but picture a flashlight or a radio set, left behind in the wilderness by [...]

Oil, F16s and and political parties cannot be bought with bitcoins. Bitcoin enthusiasts need some perspective. In the US alone, $50 billion in loyalty points are awarded every year. A quarter of these are never redeemed. Bitcoins would have to grow in value by 50 times to match this meaningless consumerism. To match the profits, as opposed to turnover, from the illicit drug market would necessitate growth by a factor of 500. But before Bitcoins have started to approach these values they have already become a minor speculative bubble in a banking cellar full of exploding magnums. Like you say, the banks need not lift a finger, greed has sealed Bitcoin's fate..

[...] Modern Chumpatronic Engineering. A reader recently asked me to comment on the demise of MtGox and its implications for Bitcoin enthusiasts. [...]

[...] undata if you will. asciilifeform yes, essentially, which is why the microscope hammer thing never persuaded me.ii * asciilifeform is firmly persuaded that every microscope is a hammer. However, not [...]

[...] "These fools have been handed a technology so clever, so disruptive and revolutionary, that the rulers of the world would have to fully unmask themselves as ruthless tyrants in order to suppress it, — or give up their thrones on their own free will — if it were used correctly, that is." Marti, 13 Ianuarie, Anul 7 d.Tr. | Autor: Mircea Popescu The title is a quote from an otherwise great article by Stan : Bitcoin, or How to Hammer in Nails with a Microscope.i [...]

[...] with technology that forces it to reveal its teeth and claws, along with the reaping of the fruit the United States Government planted in its subversion of the [...]

it's incredible that even so far as some people can see the sheer incompetence of the average crypto enthusiast they still fall for some of the more complete failures in philosophy that spawned these weirdos.

You cannot divorce society and trust from the economy because the economy is a social act perpetrated by trust.

My metaphor would not be utilizing microscopes as hammers, but clockworks as impact drill engines. Which evokes the image of steampunk, a whimsical science fantasy genre about ostentatious but ultimately impractical technology applications sustained by magical thinking and that subconsciously praises old timey British imperialism.

Dear orgo,

>... see the sheer incompetence of the average crypto enthusiast...

At the time of writing, there were no "crypto" enthusiasts yet (that particular form of grift had not been invented) -- only Bitcoin enthusiasts (and a smattering of Litecoinists mining via malware...)

> You cannot divorce society and trust from the economy because the economy is a social act perpetrated by trust.

There is, however, more than one way to establish trust and structure society.

> a whimsical science fantasy genre about ostentatious but ultimately impractical technology applications sustained by magical thinking...

Are you perchance posting from a parallel universe where Bitcoin failed? Given as in mine, it continues to work -- and continues to reliably provoke kilometres of envious, intellectually-bankrupt spew from inflationary toilet paper apologists...

Yours,

-Stanislav